In today’s fast-paced world, convenience is the king. Modern people are always seeking quick alternatives, and India is at the forefront of digital payments with UPI. To expedite the process, NPCI has introduced UPI Lite, an upgraded version of UPI. UPI Lite allows users to pay small amounts up to a certain limit without entering the pin. Here’s a quick guide to facilitate the use of UPI Lite to streamline your daily transactions.

How to use UPI Lite?

1. Open your UPI app

Open any app that supports UPI Lite. It can be any one of these apps:

- Google pay

- Paytm

- PhonePe

- BHIM

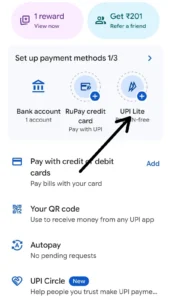

2. Select UPI Lite

Go to the UPI Lite section and select it.

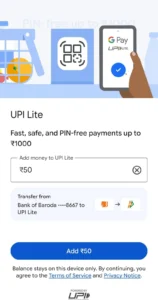

3. Add money to UPI Lite

- Add funds to UPI Lite (up to ₹2,000)

- Authenticate with UPI pin

- Funds would be transferred to your account.

4. Start using UPI Lite

Now, you are all set to use UPI Lite with ease.

How to make payments using UPI Lite?

- Open your app.

- Select UPI lite

- Select contact or scan a QR.

- Enter amount (up to 500)

- Click Pay

Voila! Your payment is completed without requiring a PIN.

Key features of UPI Lite

- Faster transaction speed.

- No PIN required to pay.

- Works better even when the bank server is down

- Reduced transaction failures.

- Seamless integration with the existing UPI app.

UPI Lite transaction limit

| Type | Limit |

|---|---|

| Maximum balance | ₹2,000 |

| Per transaction limit | ₹500 |

| Daily usage | As per the app policy |

Benefits

- Blazing Fast Payments: These payments are faster because they bypass the bank’s server.

- More Convenient: No more struggle with a slow network. One-tap payments are a boon.

- Enhanced security: Your main bank account is secured, as only limited funds are available in the UPI Lite wallet.

- Decluttered bank payments: Your bank statements remain clean, free from micro transactions.

- Improved Success Rate: Since transactions are PIN-free, failures due to server congestion are minimal.

How to add or withdraw money in UPI Lite

Add Money:

- Go to “Add funds.”

- Authenticate with UPI Pin

Withdraw money:

- Unused balance is automatically returned to the bank account.

- Manually transfer via app options

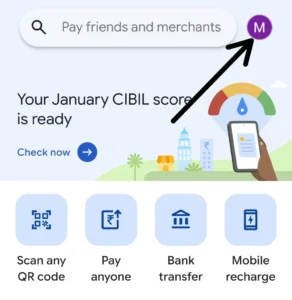

How to use UPI Lite in Google Pay

To activate UPI Lite in Google Pay, follow these quick steps:

- Open the updated version of Google Pay

- Tap your profile photo in the top right corner

- You will see the UPI Lite option under Payment settings

- Select UPI Lite.

- Add money to UPI Lite

- Authenticate with the PIN.

UPI Lite is successfully enabled in Google Pay.

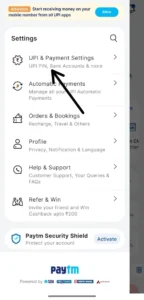

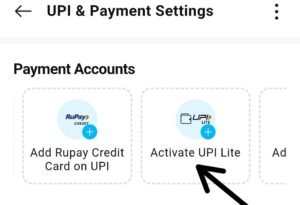

How to activate Paytm UPI Lite

- Open the Paytm app

- Tap your profile icon (top-left)

- Tap on UPI and Payment settings.

- Select UPI Lite

- Tap Enable UPI Lite

- Add money (up to ₹2,000)

- Authenticate using your UPI PIN (one-time)

Voila! Paytm UPI Lite is activated.

Common issues and troubleshooting

- UPI Lite not showing?

- Update the app

- Payment Failed?

- Check available funds and merchant support.

- Exceeded payment?

- Use Regular UPI with PIN

Conclusion

UPI Lite is a game-changer for everyday digital payments. If you frequently make small transactions and want speed, convenience, and reliability, UPI Lite is the perfect solution. With minimal setup and maximum efficiency, it’s a must-have feature for every UPI user in India.

Also, check out the blog on How to Cancel AutoPay in GPay and Paytm: A Simple Guide

Frequently Asked Questions

1. Is UPI Lite free to use?

Yes, like regular UPI, UPI Lite is free to use.

2. Can I disable UPI Lite?

Yes, you can disable UPI Lite anytime from payment settings.

3. Does UPI Lite work offline?

No, it cannot work offline, but it can work with slow connectivity.

4. What is the UPI Lite Transaction limit?

UPI Lite transaction limit is ₹2,000.